Accounting Outsourcing

SKSPL's Accounting Outsourcing Services manages your bookkeeping, compliance, and financial reporting with precision and compliance. Our CPC-aligned accounting framework ensures accurate data processing, faster reconciliations, and audit-ready financial statements.

Overview

About Accounting Outsourcing (India CPC)

Challenges

Why Organizations Choose SKSPL for Accounting Outsourcing

Simplified accounting that’s aligned with India’s CPC and statutory requirements.

Accurate financial reporting and ledger maintenance.

Centralized documentation for easy audits and reconciliations.

Reduced overhead through expert-managed outsourcing.

Integration with payroll, compliance, and ERP systems.

Confidential handling of sensitive financial data.

Centralized, CPC-Aligned Accounting You Can Trust

Benefits

Key Features of SKSPL's Accounting Outsourcing Services

Bookkeeping & Ledger Management

Day-to-day recording of financial transactions, ledger posting, and error-free reconciliations.

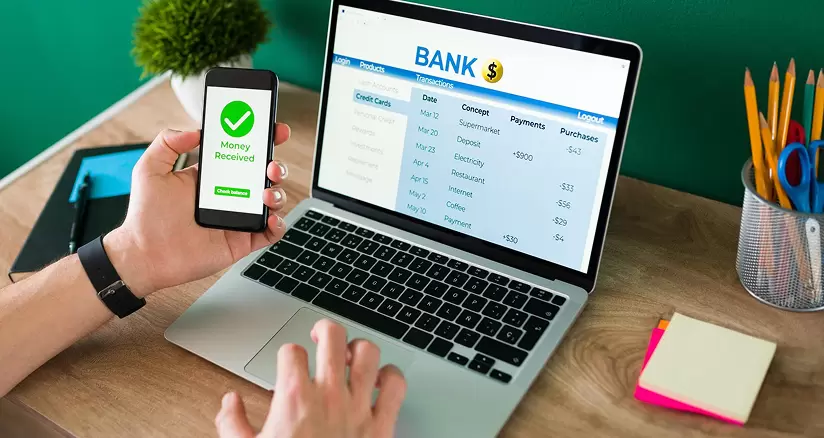

Accounts Payable & Receivable Management

End-to-end processing of vendor invoices, payments, and receivable tracking.

Bank & Vendor Reconciliation

Monthly reconciliation to maintain transparency and financial accuracy.

Payroll & Expense Accounting

Accurate posting of salary, reimbursements, and expense entries integrated with payroll data.

Financial Statements Preparation

Trial balance, P&L (Profit & Loss), and balance sheet preparation with statutory compliance.

Tax Accounting & Compliance Support

Support for TDS, GST, and other indirect tax entries aligned with CPC norms.

1

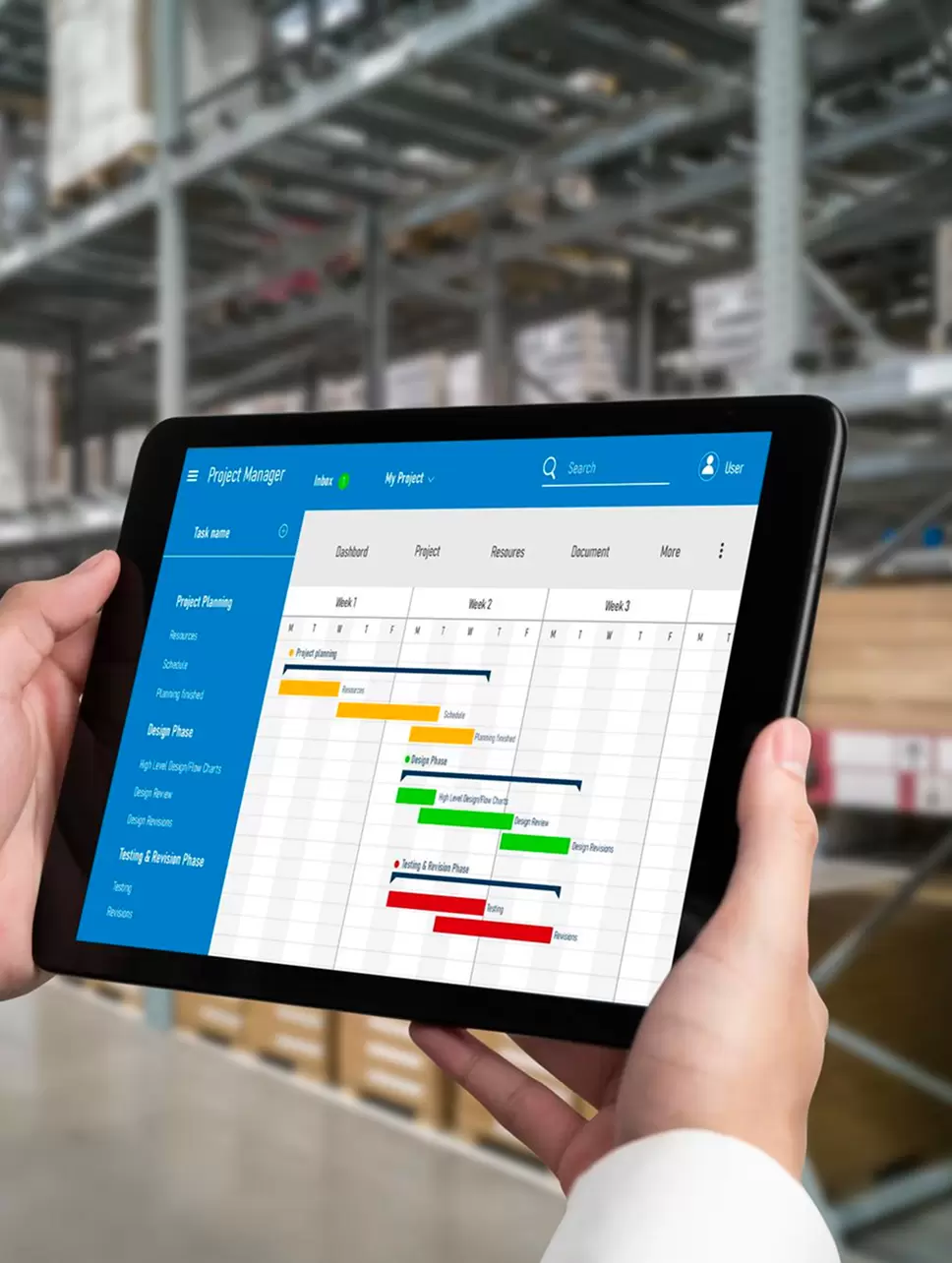

Requirement Assessment

2

System Setup & Integration

3

Processing & Reporting

4

Compliance & Filing Support

5

Review & Optimization

Our Services

Integrated Facility & Workforce Management Services

Industry-ready workforce training to produce job-ready talent through apprenticeships and national skill initiatives.